By: Saleem Khan – Chief Data & Analytics Officer – Pole Star Global

Updated Analysis: US-China Trade War Escalates as Port Fee Measures Take Effect

(Original analysis: Pole Star Global – “Potential for $23B in US Port Fees for Chinese Vessels”)

TL;DR: In April 2025, the US Trade Representative (USTR) concluded a Section 301 review and proposed new fees and trade restrictions targeting vessels and maritime services linked to China. As of 14 October, these proposals have become policy.

The US is now implementing a package of port fees and related measures on China-linked ships. In response, China immediately announced reciprocal fees on US.-affiliated vessels.

What This Means in Practice

- Fleet Reshuffling: Rapid fleet reshuffling and legal/ownership workarounds by carriers.

- Route Changes: Some rerouting of services and fewer direct calls at certain US ports.

- Higher Freight Costs: Freight cost increases passed on to shippers (and ultimately consumers) via new surcharges or higher base rates, at least in the short-to-medium term.

In this article by Pole Star Global, you’ll gain a clear understanding of how the US–China trade war is affecting key stakeholders. This article explains the policies reshaping maritime trade and details their impact on fleet deployment and freight costs. You’ll learn about the short- and medium-term effects on carriers, shippers, and consumers, as well as the legal and operational strategies being used to navigate these changes. Finally, this article explores the broader implications for trans-Pacific shipping routes and port activity, providing actionable insights to anticipate cost pressures, plan logistics strategies, and understand the evolving dynamics of one of the most consequential trade conflicts in recent history. Click on the links below to jump to the section of your choice, or scroll down to read all

.

- US-China Trade War 2025: What’s Now in Force (The Recent, Concrete Steps)

- Immediate Industry Responses: Carriers, Trade Groups, and Cost Implications

- Will Chinese Ships Reduce US Calls? Short Answer: Yes, But With Caveats

- Port Fees: Who Ends Up Paying – Carriers, Shippers, or Consumers?

- Likely Market Dynamics and Second-Order Effects

- How to Navigate the US-China Trade War in 2025: Practical Advice for Shippers, Ports, and Stakeholders

- Bottom Line: Pole Star Global’s Perspective

US-China Trade War April 2025: What Was Decided? (Short Recap)

On 17 April 2025, the US Trade Representative (USTR) issued a formal notice under Section 301, concluding that China’s policies in the maritime, logistics, and shipbuilding sectors were unfair and “actionable”.

In response, the USTR proposed a package of measures, including new port-call fees and service charges targeting Chinese-owned, operated, or built vessels, along with tariffs and equipment restrictions aimed at countering China’s dominance in shipbuilding and logistics.

The proposal outlined several possible fee structures, ranging from per-ton charges to flat-rate port fees that could reach substantial sums for certain vessels.

US-China Trade War 2025: What’s Now in Force (The Recent, Concrete Steps)

US Implementation: The USTR’s package has moved from proposal to enforcement. According to legal summaries and regulatory notices, port fees and related measures listed in Annexes I–III began being billed on 14 October 2025. The regime also includes planned increases in the coming years and limits on the number of billable voyages per ship each year.

China’s Retaliation / Reciprocal Measures: China announced reciprocal measures that took effect at the same time, imposing special port charges on vessels linked to the US, including those with US ownership, US flag, US operation, or more than 25% US equity.

The initial fee is reported at RMB 400 per net ton, with planned increases in later years. China has also indicated limited exemptions (for example, some China-built ships) and stated that the fee will apply at the first Chinese port of call and be capped per vessel per year.

Immediate Industry Responses: Carriers, Trade Groups, and Cost Implications

The shipping industry and trade associations responded immediately to the new port fee measures. These reactions are summarised below:

- Carriers and Operators Are Adjusting Sailings and Redeploying Tonnage: Reports indicate some east–west sailings are being cancelled, while load factors rise on remaining voyages. This is a typical short-term response as carriers try to limit exposure and rebalance capacity.

- Trade Associations Warn of Port Diversions and Economic Impact: Groups such as the American Apparel & Footwear Association (AAFA) caution that fees could lead carriers to reroute North American calls to Canada or Mexico, potentially reducing cargo volumes and activity at affected US ports.

- Analysts Highlight Major Cost Implications for Chinese Carriers: Estimates suggest the fees could add hundreds of millions to billions of dollars annually for major operators like COSCO and OOCL. Carriers are pushed to consider whether to absorb the cost, change deployment, or add surcharges.

Will Chinese Ships Reduce US Calls? Short Answer: Yes, But With Caveats

Near-Term Outlook: Carriers are expected to avoid, reduce, or reconfigure direct calls by Chinese-owned or Chinese-built vessels wherever possible.

Why This Is Happening:

- Economic Pressure: The fees imposed are substantial, giving carriers a strong incentive to sidestep them. This could involve redeploying non-Chinese-built ships to US routes, diverting services to third-country ports, or adjusting ownership, flag, or charter arrangements to fall outside the fee rules. Early industry reports already show carriers moving quickly to reshape their fleet strategies.

- Operational Flexibility: Carriers have multiple workarounds at their disposal. Reflagging vessels, adjusting commercial charters, partnering with third-party operators, and short-term vessel swaps are all feasible strategies. These approaches allow carriers to reduce fee exposure without impacting overall shipping capacity.

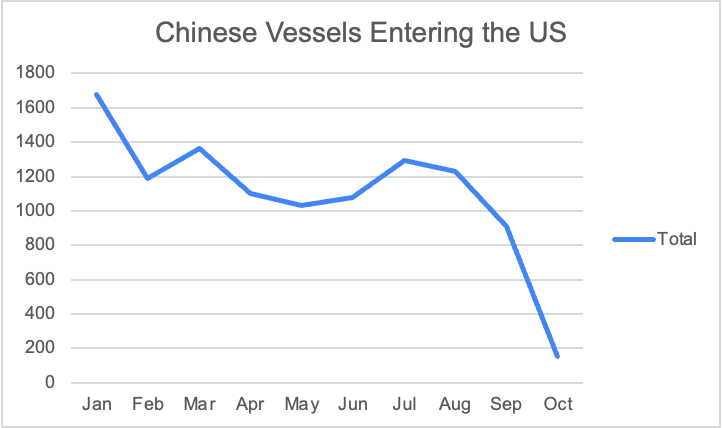

The Numbers Tell the Story: 54% Decline in US Port Calls for Chinese-Built Vessels

Pole Star Global’s aggregate sanction screening data offers a window into the current state of Chinese port calls to the US.

US port calls by Chinese-built vessels have already fallen by 54% this year. In January, 1,678 Chinese vessels were screened at US ports, dropping to 908 by September. While October is still incomplete, early data shows the decline continuing rapidly.

Conclusion: In the near term, direct calls by Chinese-flagged or Chinese-built vessels to US ports are expected to decline. While an immediate, widespread withdrawal of “Chinese ships” from global trade is unlikely, fleet owners will need to adopt creative strategies to navigate the evolving landscape.

Port Fees: Who Ends Up Paying – Carriers, Shippers, or Consumers?

Projected Impact: Shippers take the immediate hit, and some costs eventually trickle down to consumers.

Supporting Evidence and Reasoning for the Projected Impact

- Carriers Pass Costs to Shippers: Discrete, voyage-specific fees are usually passed on to customers. Industry analyses and carrier statements suggest that shipping lines are likely to add new line-item surcharges or implement general rate increases (GRIs) to recover per-voyage or per-container costs. This approach aligns with the industry’s typical response to new regulatory or tariff-style charges. Multiple carrier and logistics sources note that “nearly all carriers will pass these fees through to shippers”, either as separate charges or folded into higher base rates.

- Shippers Bear the Initial Burden: Importers and exporters have limited immediate options. They may attempt to re-route shipments, consolidate cargo, or renegotiate terms; however, for many goods and trade lanes, there are no low-cost alternatives. As a result, the initial cost impact falls on shippers. Logistics providers and freight forwarders have already signalled that they will implement surcharges.

- Consumers Will Feel the Ripple Effect: Over time, added transport costs are likely to reach consumers. Analyses from The Trade Partnership and other studies indicate that higher shipping fees lead to increased retail prices, particularly for goods with limited domestic supply elasticity. Legal, academic, and policy studies have warned that raising prices through these fees could negatively impact GDP. The pattern is clear: higher transport costs increase landed cost and squeeze margins. If companies cannot absorb these expenses, partial pass-through to consumers is highly likely.

Limited Absorption: Most Carriers Will Pass on Rising Fees

In some cases, carriers with diverse fleets or strong financial positions might temporarily absorb a small portion of the fees to protect their market share. However, this is expected to be rare. As the fees increase in the coming years, most carriers will pass the costs on. Analysts estimate that, for major Chinese carriers, the total bill could reach hundreds of millions to low billions of dollars, far too large to absorb indefinitely.

Likely Market Dynamics and Second-Order Effects

- Route Diversion to Nearby North American Ports: Some carriers may reroute cargo through Canada or Mexico to avoid US fees, putting extra pressure on those ports and inland transportation networks. This would reduce US port volumes and could affect longshore labour and terminal economics. Trade groups have already flagged this as a likely outcome.

- Legal and Financial Workarounds: Carriers may use strategies such as ownership restructuring, flag changes, and charter swaps to limit fee exposure. These moves will increase compliance and documentation demands for US customs and port authorities.

- Short-Term Freight Volatility: Cancelled sailings and vessel redeployments will likely cause spot-market fluctuations. Carriers may introduce GRIs or surcharges to recover costs, temporarily tightening capacity and driving spot rates up.

- Shipbuilding Effects Are Slow: While the policy aims to discourage ordering at Chinese shipyards, the impact may be gradual and partial. Global capacity, pricing, and lead times mean that any shift to non-Chinese yards will take time. Analysts caution that market-share changes could take years to appear.

How to Navigate the US-China Trade War in 2025: Practical Advice for Shippers, Ports, and Stakeholders

- Shippers: Review contracts and terms, budget for new surcharges, consider alternative routes or ports, and renegotiate long-term freight agreements where possible to lock in rates. Be prepared for higher freight invoices in Q4 2025 and 2026 as fees increase.

- Ports & Terminals: Analyse potential volume reductions and plan for the displacement of calls. Engage with local stakeholders – including importers, terminals, and labour – to estimate impacts on jobs and throughput.

- Carriers / Owners: Audit ownership and fleet structures to determine fee exposure. Clearly communicate surcharges to customers and document compliance steps in accordance with the fee rules.

Bottom Line: Pole Star Global’s Perspective

The new port-fee regime, and China’s immediate reciprocal measures are already reshaping the shipping market. In the short term, expect route diversions, cancelled sailings, and upward pressure on freight rates as carriers pass the fees on through surcharges or GRIs.

Over the next 1–3 years, the policy may influence fleet deployment and ordering decisions, but significant shifts in the global shipbuilding market share will take time. Real structural change requires capital investment, incentivised procurement, and large-scale industrial adjustments – factors far beyond the scope of port fees alone.

Overall, the policy is set to increase friction and costs across trans-Pacific trade, with the impact likely felt first by shippers and, eventually, by consumers, unless market forces or policy interventions provide offsets.