Summary of the EU 17th Sanctions Package:

The EU 17th Sanctions Package represents a major escalation in efforts to dismantle Russia’s shadow oil trade infrastructure, often referred to as the “Dark Fleet”.

The new measures include the designation of 189 vessels, nearly doubling the number of tankers previously sanctioned by the EU. Furthermore, this latest round of sanctions signals a shift towards not only targeting individual vessels, but also the complex web of companies enabling them.

Targeting Front Companies and Dark Fleet Enablers

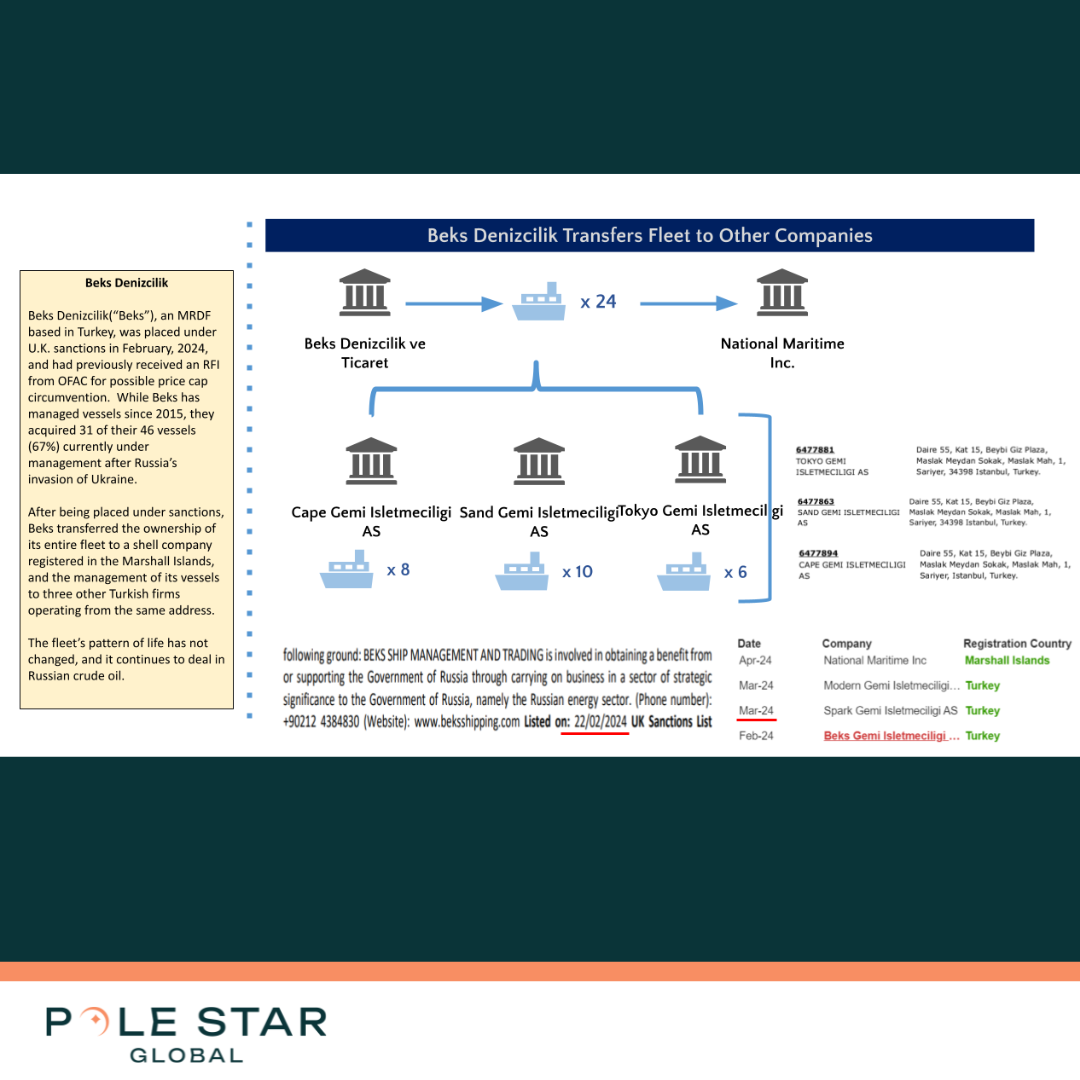

Among the most notable entities sanctioned are Cape Gemi Işletmeciliği AŞ (“Cape Gemi”) and Prominent Shipmanagement, both significant players in Russia’s illicit maritime operations.

DBI identified Cape Gemi as a front company for Beks Denizcilik ve Ticaret (“Beks”), which is already subject to UK sanctions.

Prominent Shipmanagement, meanwhile, is one of the few actors which we classify as a Major Russian Dark Fleet actor (MRDF) already under U.S. sanctions. You can read more about this in the following case study by Pole Star Global and key partner Blackstone Compliance Services, published last September. To access the full report, please complete the form below.

Despite this development, experts at Pole Star Global and Blackstone Compliance Service’s DBI (Deep Blue Intelligence) point out that the EU’s sanctions list remains incomplete.

Firstly, while Cape Gemi and Prominent Shipmanagement operate 41 vessels collectively, only 21 (51%) have been sanctioned.

Secondly, Beks continues to operate two additional front companies at the same address as Cape Gemi, yet these remain unlisted.

How Seychelles-Based Entities Obscure Maritime Ownership

The EU has also targeted a recurring sanctions-evasion pattern involving SPVs incorporated in the Seychelles.

These entities, often managed on behalf of Azerbaijani or Moldovan interests, act as vessel owners to obscure beneficial ownership. The Seychelles has come up as a key jurisdiction for sanctions evaders to incorporate companies anonymously. This isn’t just related to Russia sanctions. For example, a key intermediary for Iran’s sprawling Triliance group, which sells oil on behalf of the IRGC, operates out of the Seychelles.

EU Aligns With the UK to Sanction VSK Insurance

One of the most strategic moves in the EU’s 17th sanctions package is the designation of VSK Insurance Joint Stock Company (VSK), a major provider of Protection and Indemnity (P&I) insurance to sanctioned or high-risk Russian vessels.

Already under UK sanctions, this development marks a continuation of EU alignment, whereby the EU harmonises its approach with the UK when it comes to sanctioning insurers that underpin the Dark Fleet’s operations. VSK is also reinsured by the Russian National Reinsurance Company (RNRC), which is itself a sanctioned entity, effectively rendering its coverage unenforceable. DBI has identified 366 vessels insured or suspected to be insured by VSK, raising concerns over maritime risk and liability.

Expanded Focus on Oil Trade Facilitators

The EU also levelled sanctions against several Russian entities facilitating crude oil exports outside the price cap regime. These include:

- Volgo Shipping

- Eiger Shipping DMCC (the chartering arm of Litasco)

- Surneftegaz (already under U.S. blocking sanctions)

- Avebury Shipping, a Sovcomflot shell entity

These additions reflect a broader EU strategy to not only sanction physical assets but also the network of operators, charterers, and insurers keeping Russia’s oil export machine functioning.

DBI and Pole Star Global Continue to Monitor Unsanctioned High-Risk Vessels

Despite the breadth of the EU’s 17th sanctions package, DBI reports that EU action still only scratches the surface. According to DBI data, less than half of the vessels operated by the top eight MRDF actors have been sanctioned. Pole Star Global’s and DBI’s watchlists continue to monitor hundreds of additional vessels tied to sanctioned entities, offering clients proactive intelligence and full narrative dossiers. For example, see the Beks storyboard below.

The sanctions also targeted a hodgepodge of vessels operating on behalf of other MRDFs, such as Gatik Ship Management. In our MRDF report from September, 266 tankers were identified, operated by eight fleets suspected to be involved in evading the price cap or other Dark Fleet activities (e.g., dealing in Iranian crude).

So far, EU sanctions have only targeted 89 of those vessels (33%). Even if one fleet is removed that mostly deals with Iran (Russia is their side business), EU sanctions still cover only 43% of the vessels identified by Pole Star Global’s key partner Blackstone Compliance Services.

EU’s 17th Sanctions Package Expands Crackdown on Russia’s Dark Fleet

The EU’s latest sanctions underscore a growing willingness to strike at the structural and financial underpinnings of Russia’s Dark Fleet. The inclusion of insurers, shell companies, and front operators shows an evolving strategy to close the enforcement gap.

Understanding a vessel’s history is no longer sufficient. True compliance now demands insight into ownership structures, sanctions-evading typologies, and associated risk networks.

With nearly 1,500 vessels identified as being insured by high-risk or sanctioned P&I clubs, the EU’s latest designations may just be the beginning. The EU’s move to align more closely with UK and US approaches hints at further crackdowns ahead in the global effort to dismantle Russia’s Dark Fleet.