Vessel Traffic Analysis Following U.S. Military Operations Against Iran – Pole Star Global Research

Executive Summary

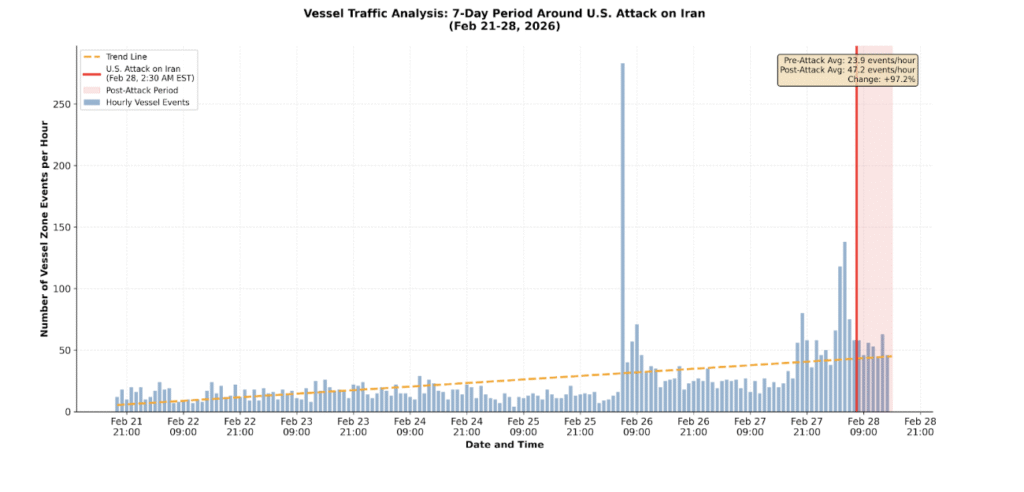

Pole Star Global has analysed 3,878 vessel zone events in the Persian Gulf region during the seven-day period surrounding U.S. military strikes against Iranian targets on February 28, 2026. Maritime traffic increased 162% on the day of operations, with sustained elevated activity in the post-strike period. This brief provides vessel owners, operators, insurers, and financial institutions with operational intelligence and near-term recommendations.

Maritime Traffic Volume Assessment

Analysis of vessel zone events from February 21–28, 2026 reveals significant fluctuations in maritime activity, with February 28 recording the highest single-day volume of the period.

- Baseline Period (Feb 21–27): Average 417 events/day (19.7 events/hour)

- February 28 (Strike Day): 956 events (63.7 events/hour)

- Traffic Increase: +162% versus baseline

The peak hourly activity occurred at 05:00 UTC with 138 vessel zone events — representing a 7-fold increase over baseline hourly traffic. Post-strike activity (after 07:30 UTC) remained elevated at 51.8 events/hour, indicating sustained maritime operations in the region.

Vessel Activity by Type and Flag State

Analysis of vessel types and flag state registrations provides insight into operational patterns during and immediately following the military action.

Post-Strike Activity (First 6 Hours):

- Tugs: 56 events (18% of traffic) – significant increase from 9% baseline

- Crude Oil Tankers: 38 events (12%)

- General Cargo: 37 events (12%)

- Platform Supply Ships: 31 events (10%)

- Container Ships: 24 events (8%)

The substantial increase in tug activity is consistent with emergency response operations, salvage preparation, and vessel assistance. Platform supply ships showed increased activity, likely supporting offshore installations and providing emergency services.

Iranian-flagged vessels showed a marked reduction in activity post-strike, declining from 940 events in the pre-strike period to 41 events in the six hours following military operations — a 95.6% decrease. Conversely, vessels registered in Panama, Liberia, and the UAE increased their operational presence.

Operational Movement Patterns

Event type analysis reveals important patterns in vessel movement decisions:

- Pre-Strike Period: Balanced entry/exit ratio (53% entries, 47% exits)

- Post-Strike Period: 69% zone entries versus 31% exits

The higher proportion of zone entries post-strike suggests emergency response positioning, support operations, and potential search and rescue readiness rather than general evacuation from the region.

Regulatory and Security Advisories

Maritime authorities have issued critical advisories for vessels operating in the region:

- U.S. Maritime Administration (MARAD) Alert 2026-001A: Vessels are advised to maintain a minimum 30 nautical mile standoff from U.S. military vessels operating in the Strait of Hormuz, Persian Gulf, Gulf of Oman, and Arabian Sea due to ongoing military operations and potential retaliatory action.

- UK Maritime Trade Operations (UKMTO) Advisory 003-26, Update 01: Heightened vigilance required for all transiting vessels. Mariners should report any suspicious activity and maintain enhanced watch protocols.

Near-Term Recommendations

For Vessel Owners and Operators

- Maintain 30+ nautical mile standoff from U.S. military vessels and reported strike zones

- Enhance bridge watch protocols and maintain 24/7 communications monitoring

- File detailed voyage plans with flag state authorities and update routing through UKMTO/MARAD channels

- Ensure AIS broadcasting is continuous and verify all safety and communications equipment is operational

- Brief crews on current threat environment and establish emergency communication protocols

- Consider alternative routing if operationally and commercially feasible

- Coordinate with private maritime security providers for threat assessments and routing guidance

For Marine Insurers and Underwriters

- Review war risk and political violence coverage for vessels currently in or transiting to the Persian Gulf

- Reassess premium structures based on elevated operational risk environment

- Verify compliance with JWC Hull War, Piracy, Terrorism and Related Perils Listed Areas

- Require enhanced reporting from insured vessels operating in the region

- Monitor traffic patterns and vessel concentrations for exposure management

For Ship Financiers and Trade Banks

- Assess collateral exposure for vessels operating in the Strait of Hormuz and Persian Gulf region

- Review covenant compliance related to operational areas and insurance requirements

- Monitor vessel positioning and voyage patterns through AIS and intelligence sources

- Engage with borrowers to confirm insurance coverage adequacy and compliance with advisories

- Consider trade finance implications for cargo destined to/from the region

Operational Outlook

Maritime activity in the Persian Gulf remains elevated following the February 28 U.S. military strikes. The 162% increase in vessel traffic on the day of operations, combined with sustained post-strike activity, indicates an active operational environment requiring heightened awareness from all stakeholders. Pole Star Global continues to monitor vessel movements and will provide updated intelligence as the situation evolves.

Stakeholders are strongly encouraged to maintain real-time maritime domain awareness, comply with all regulatory advisories, and exercise enhanced operational caution when operating in or near the region.

References and Advisory Sources

- U.S. Maritime Administration (MARAD) Alert 2026-001A: “Strait of Hormuz, Persian Gulf, Gulf of Oman, and Arabian Sea – Military Operations and Potential Retaliatory Strikes.” February 28, 2026. View Advisory

- UK Maritime Trade Operations (UKMTO) Advisory 003-26, Update 01. February 28, 2026. View Advisory

- Pole Star Global Maritime Intelligence: Vessel Zone Event Tracking Analysis, February 21–28, 2026. Dataset: 3,878 vessel events (data anomalies removed).

About Pole Star Global: Pole Star Global provides maritime domain awareness and intelligence solutions to vessel operators, insurers, financial institutions, and government agencies worldwide. For additional intelligence or inquiries: www.polestarglobal.com

Methodology Note: This analysis covers 3,878 vessel zone events from February 21-28, 2026. Data quality controls included removal of system anomalies (283 events on Feb 26, 06:00 UTC) to ensure analytical accuracy.