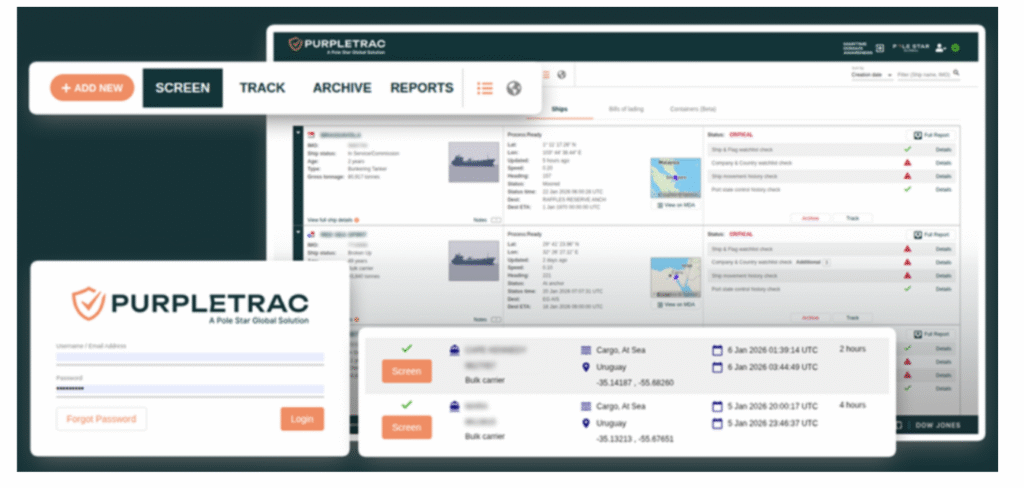

PurpleTRAC (Maritime Risk & Compliance)

Refreshed Brand Identity

What’s new

Refreshed PurpleTRAC look, including a new logo and updated brand colours, as part of Pole Star Global’s wider brand evolution.

Why it matters

- A clearer, more recognisable identity that makes it easier to spot official PurpleTrac communications and updates.

- A cleaner interface designed to improve consistency across Pole Star Global products, without changing how you use PurpleTrac today.

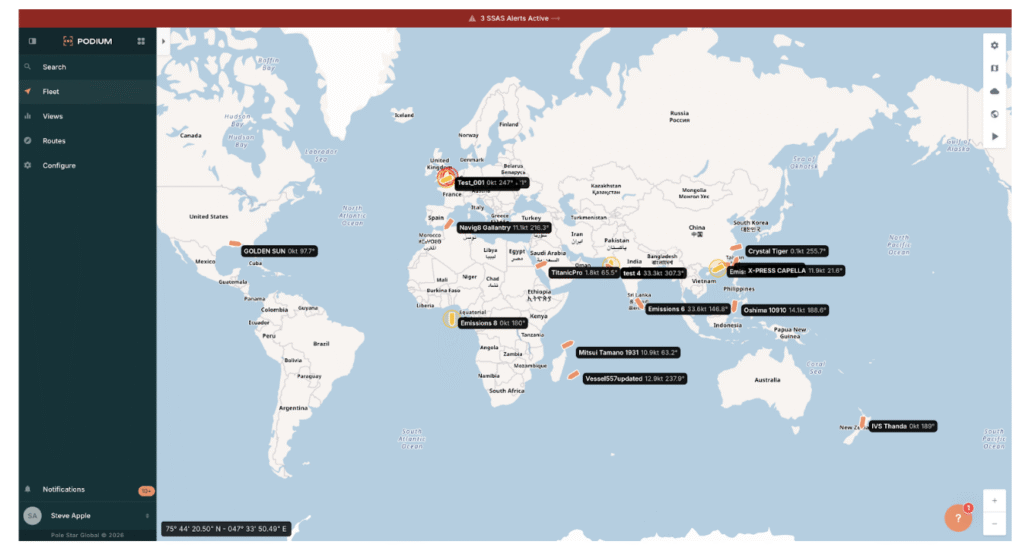

Podium (Shipping & Offshore)

New Look User Interface

What’s new

Refreshed Podium user interface and navigation experience, including a new collapsible side navigation bar, updated colours, fonts, and logo as part of Pole Star Global’s wider brand evolution.

Why it matters

- Enhanced visual consistency across Pole Star Global products, while keeping all existing menus, URLs, and workflows unchanged.

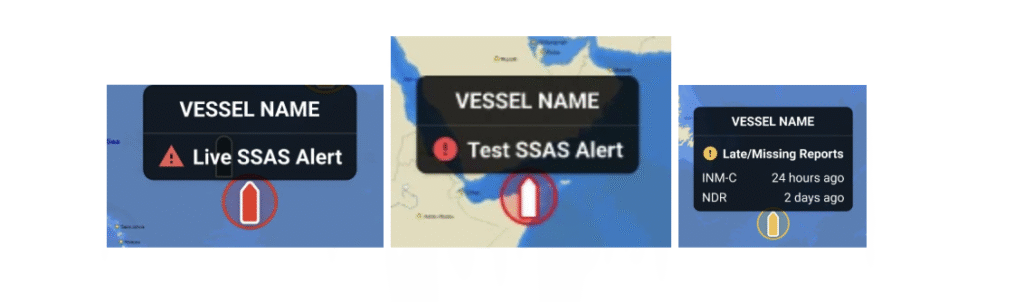

SSAS – Vessel Icons & Colours

What’s new

- Live SSAS Alert – Red icon with white border and red circle

- Test SSAS Alert – White icon with red border and red circle

- Warnings – Yellow icon with white border and yellow circle for late/missing reports

- Colour-coded labels offer clear distinction between alert types

Why it matters

- Instantly identify alert type at a glance – no more ambiguity

- Faster, more confident response to genuine security events

- Reduced risk of misidentifying test alerts as live incidents

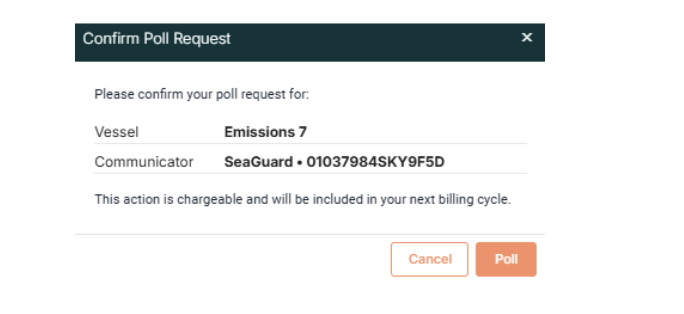

Poll – On-Demand Position Request

What’s new

- Request a vessel’s real-time position instantly, without waiting for the next scheduled report

- One-click Poll button directly from the vessel card on the fleet page

Why it matters

- No more waiting for scheduled Sat-C reporting intervals

- Improves decision making in time-critical situations

Data Insights

Vessel Port Calls API — Berth-Level Event Tracking

What’s new

- The Vessel Port Calls API now returns berth arrival and berth departure events in addition to existing port area events.

- Each berth event includes berth name and unique berth ID.

- Enables tracking from port approach through to specific berth locations.

For technical documentation, refer to our developer portal.

Why it matters

- Unlocks accurate berth-level dwell time analysis.

- Improves terminal utilisation and congestion visibility.

- Enables more precise ETA modelling and operational performance tracking.

- Supports better berth allocation planning for ports.

- Enhances supply chain predictability and demurrage cost management.

Vessel Positions API — Flexible Real-Time Geographic Search

What’s new

- New Vessel Positions API endpoint: POST /unified-position/v1/positions

- Real-time vessel position search using custom polygon zones, circular zones (latitude / longitude / radius), and vessel identifiers (MMSI, IMO, name)

- Returns navigational status, speed, course, destination, and vessel characteristics.

- Supports configurable downsampling and pagination.

For technical documentation, refer to our developer portal.

Why it matters

- Enables real-time situational awareness across dynamic, custom-defined areas.

- Supports monitoring of irregular coastlines, shipping lanes, emergency zones, and regulatory areas.

- Eliminates reliance on static, pre-configured zones.

- Accelerates operational response during evolving events.

- Expands use cases requiring flexible spatial intelligence.

Meridia

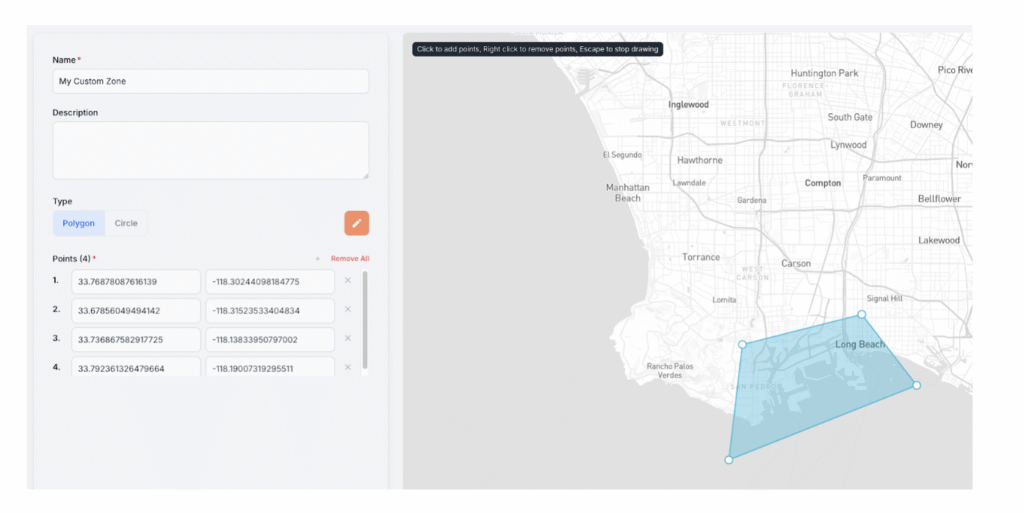

Custom Geographic Zones (In-UI Creation & Monitoring)

What’s new

- Users can now create custom geographic zones directly within the Meridia UI.

- Supports polygon and circular zone creation via interactive map.

- Real-time coordinate and radius editing.

- Custom zones generate vessel entry/exit events.

- Fully integrated with notifications, screening workflows, and analytics.

- Accessible via: Library > Zones > Custom Zones

Why it matters

- Enables precise monitoring of operationally relevant areas without API integration.

- Supports temporary or evolving surveillance zones.

- Matches exact regulatory or operational boundaries.

- Reduces dependency on support requests or overlapping static zones.

- Improves operational flexibility and response speed.

MDA (Government Global Services)

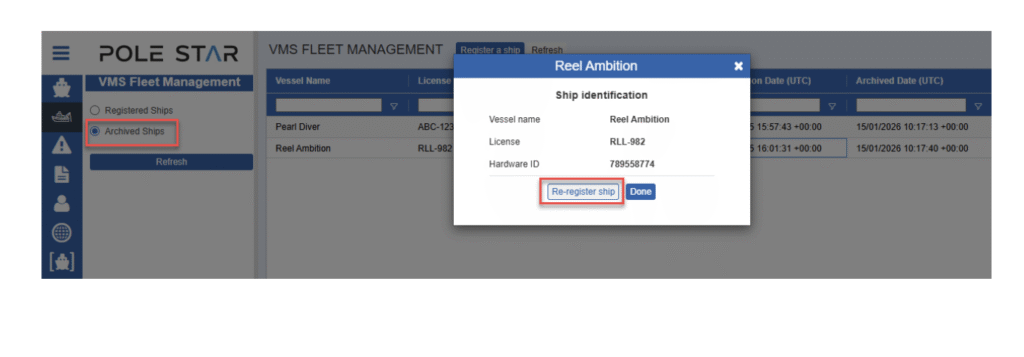

VMS Fleet Management – Archived Ship Re-registration

What’s new

VMS Fleet Management now allows archived ships to be re-registered. Users can restore a vessel from the Archived Ships view back into the active fleet, without creating a new record. This ensures vessels that return to service can be reactivated quickly, while retaining their existing history.

Why it matters

- Supports real-world vessel lifecycle changes without duplication

- Retains historical data while restoring full operational visibility

- Simplifies fleet management as vessels move in and out of service

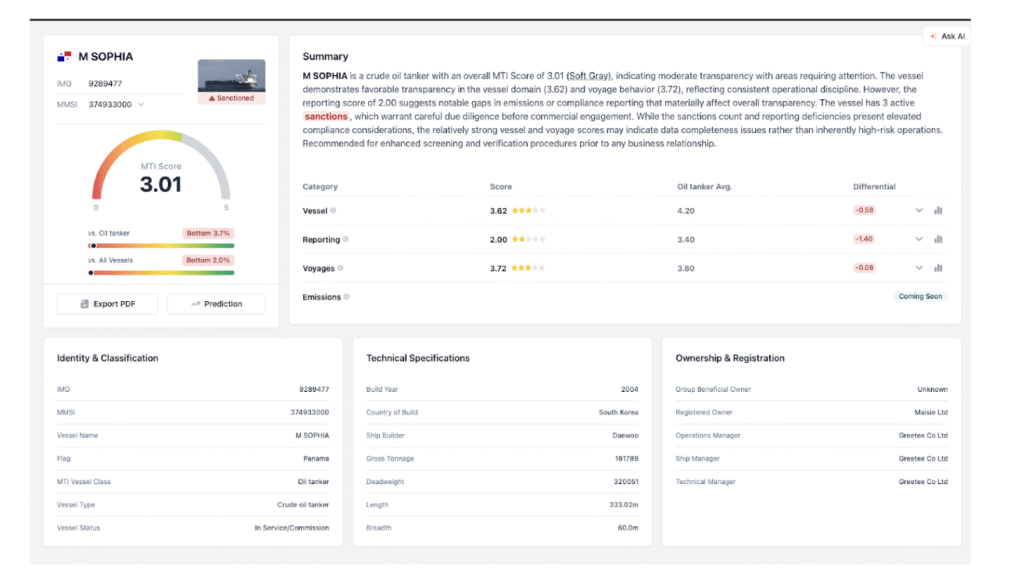

Maritime Transparency Index

MTI — My Vessel

What’s new

- Introduction of the MTI Score, providing an overall measure of vessel transparency and operational integrity based on behaviour, reporting quality, and voyage patterns.

- New Score Summary section offering structured, AI-generated narrative explanations of the vessel’s MTI results.

- Component-level scoring framework including:

- Vessel Score (historical and structural attributes such as age, ownership changes, flag transitions, sanctions history, deficiencies and detentions)

- Reporting Score (AIS reporting integrity, gaps, frequency, duration, spoofing indicators)

- Voyage Score (port calls, STS activity, dwell time, slow steaming, unexplained delays)

Why it matters

- Quickly assess vessel transparency and operational risk through a single consolidated score.

- Understand the underlying drivers behind performance using clear, structured explanations.

- Reduce manual analysis while preserving scoring accuracy and consistency.

ℹ️ Narrative explanations are generated using advanced GenAI models. Score values and scoring logic remain unchanged.

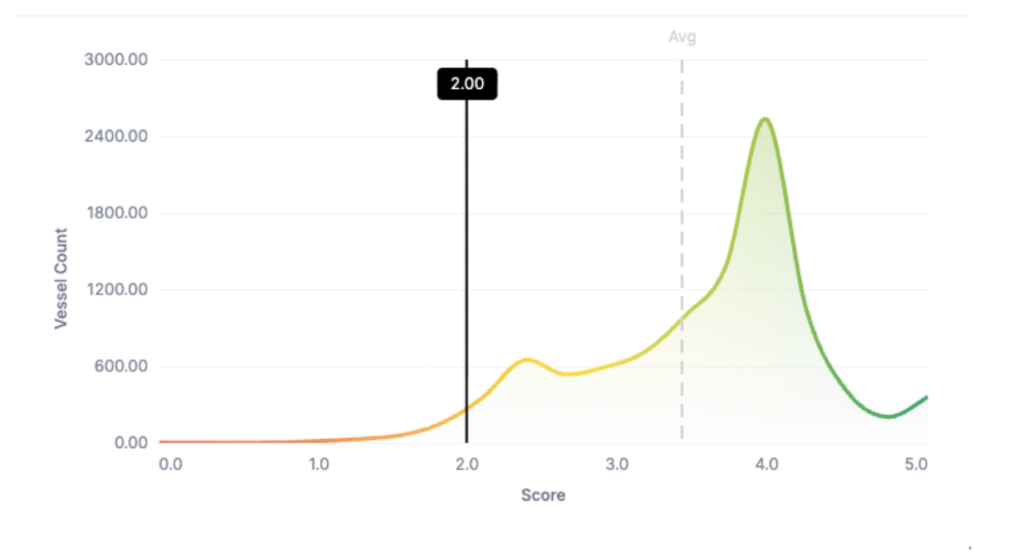

MTI — Categorical Score Distribution Comparison

What’s new

- Visual comparison of a vessel’s MTI score against the full distribution of scores within its vessel category (e.g., oil tankers).

- Distribution curve showing how vessels are spread across the MTI range.

- Category average reference line.

- Display of the differential between the vessel’s score and the category average.

Why it matters

- Adds contextual understanding by showing how a vessel performs relative to peers.

- Highlights deviations from expected transparency or compliance norms.

- Enables more informed assessment of operational and category-specific risk.

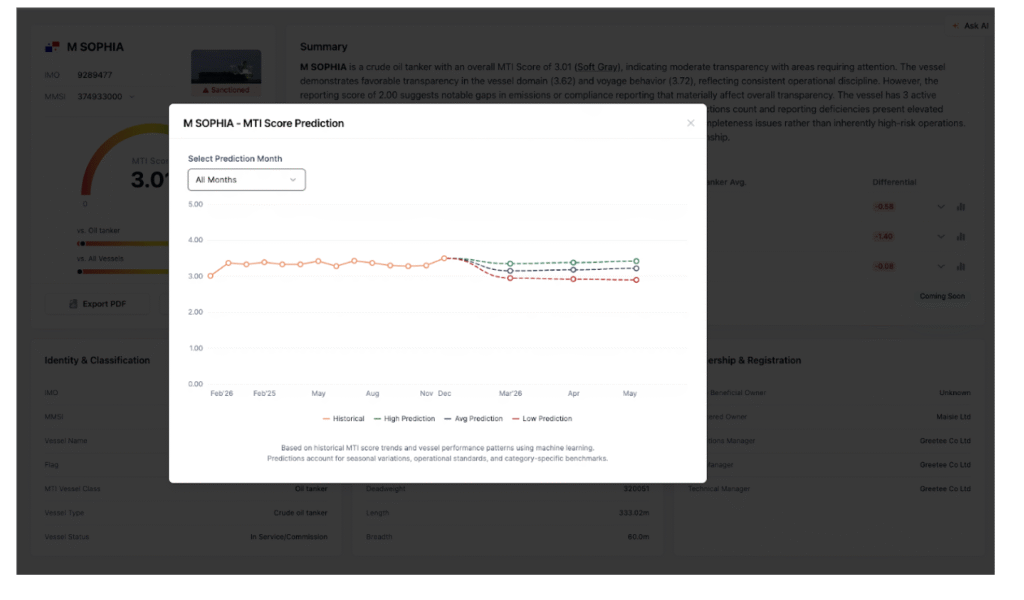

MTI — Score Prediction (Forward-Looking Insights)

What’s new

- MTI Score Prediction powered by historical score trends and machine learning analysis.

- Three forecast scenarios:

- High Prediction (best case performance range)

- Average Prediction (most likely expected outcome)

- Low Prediction (conservative performance scenario)

- Dynamic updates as new MTI performance data becomes available.

Why it matters

- Provides forward-looking visibility into expected MTI performance.

- Identifies potential transparency or compliance shifts early.

- Supports proactive operational planning and commercial decision-making.

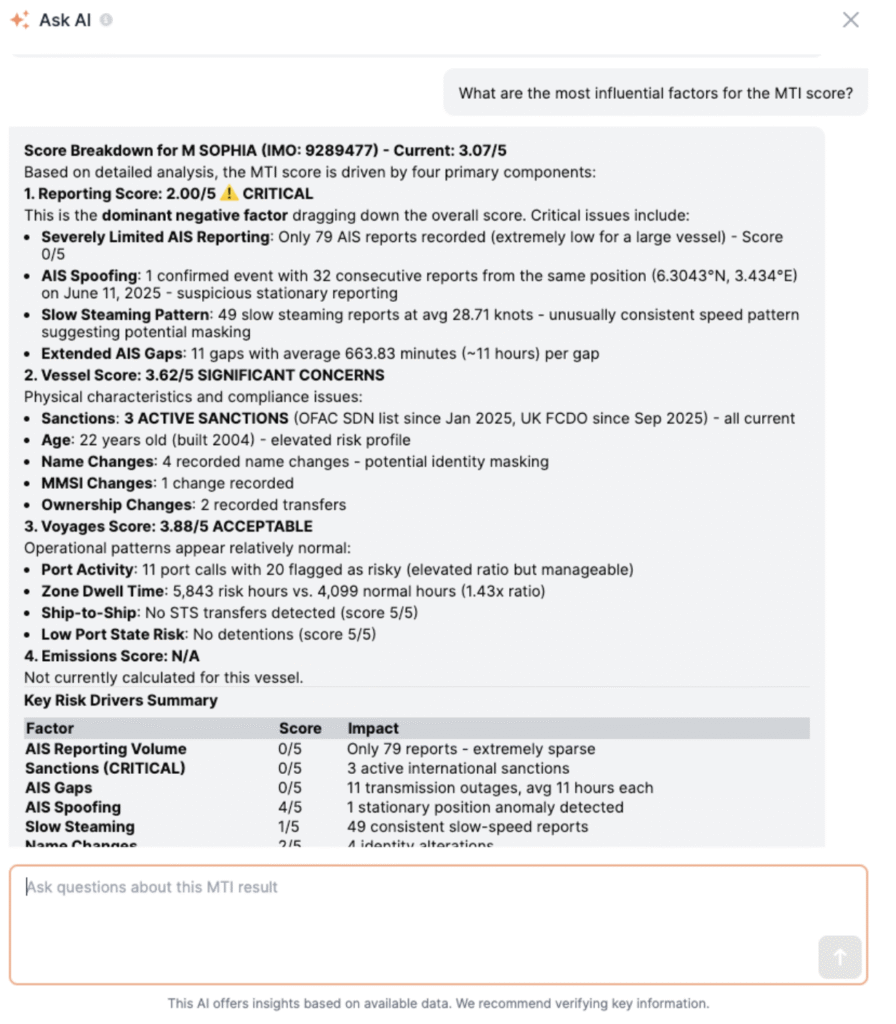

MTI — Ask AI Assistant

What’s new

- Natural language AI assistant enabling users to ask structured questions about a vessel’s MTI profile.

- Component-level score breakdowns and key performance drivers.

- Structured explanations of reporting behaviour, voyage patterns, and risk indicators.

- Integration of predictive insights when score forecasting data is available.

Why it matters

- Simplifies interpretation of complex MTI scoring signals.

- Improves transparency into risk contributors and behavioural patterns.

- Reduces the need for manual investigation across multiple datasets.

- Supports compliance, risk, and operations teams with clear, contextual insights.

ℹ️ All AI-generated explanations interpret available MTI data without modifying underlying score values.

MTI — Vessel Technical & Ownership Panels

What’s new

- Identity & Classification Panel (IMO number, MMSI, vessel name, flag, class, vessel type).

- Technical Specifications Panel (build year, country of build, tonnage, dimensions, hull details).

- Ownership & Registration Panel (beneficial owner, registered owner, operations manager, technical manager).

Why it matters

- Strengthens vessel identity verification and screening workflows.

- Improves detection of identity inconsistencies or ownership opacity.

- Supports sanctions exposure analysis and due diligence processes.

- Enhances contextual understanding of vessel operational background.

Coming Up

MTI — My Fleet (Fleet View)

What’s coming

- Unified fleet-level MTI dashboard.

- Consolidated fleet MTI score.

- Risk segmentation and score distribution views.

- Vessel-level insights including key risk drivers and recent score changes.

- Filtering across flags, vessel types, and risk categories.

- AI-powered explanations for fleet-wide insights.

- PDF export for reporting.

Why it matters

- Enables portfolio-wide transparency oversight.

- Identifies high-risk vessels and emerging exposure patterns.

- Supports compliance reporting and executive-level visibility.

Ask AI Assistant — User Journey Enhancements

What’s coming

- Guided leading questions to support faster analysis.

- Historical conversation view for continuity and tracking.

- Integrated map visualisations within chat for voyage and behavioural questions.

- Additional graphical insights (scatter graphs, bar charts, line graphs).

Why it matters

- Improves workflow continuity and usability.

- Enhances interpretability of MTI components through visual context.

- Supports deeper behavioural and geographical analysis.

New Score Categories

Emissions Score

What’s coming

Environmental transparency measure within MTI. Evaluation of total CO₂ emissions, emission intensity factors, activity in Emission Control Areas, slow steaming behaviour, and alignment with environmental standards.

Why it matters

- Expands MTI into environmental risk and sustainability transparency.

- Supports regulatory reporting and operational benchmarking.

- Strengthens fleet-level environmental exposure assessment.

Sanctions Score

What’s coming

Dedicated sanctions risk assessment within MTI. Analysis of historical sanctions records, active listings, and ownership-related sanctions exposure.

Why it matters

- Consolidates sanctions-related transparency signals.

- Strengthens due diligence and compliance confidence.

- Provides clearer visibility into sanctions-linked vessel risk.