Recent Yemen sanctions imposed by the U.S. Treasury highlight escalating compliance risks for vessels operating near Houthi-controlled ports.

By: Saleem Khan – Chief Data & Analytics Officer – Pole Star Global

U.S. Expands Yemen Sanctions to Target Fuel Deliveries to Houthi-Controlled Ports

The U.S. Treasury just added new names to its list of sanctioned ports and shipping companies. These new sanctions target vessels that recently delivered fuel to Houthi-controlled ports in Yemen after a key U.S. license allowing such deliveries expired on April 4, 2025.

Why does this matter? Because the Houthis, an armed group supported by Iran, control major ports along Yemen’s Red Sea coast – especially Hudaydah, Ras Isa, and Saleef. The U.S. government says these ports are being used to “funnel millions of dollars derived from port revenue (seizure of refined petroleum products)”. The group sells fuel on Yemen’s black market at high prices to fund attacks on commercial ships, harming global trade and threatening lives.

The Treasury’s actions, made under a special counterterrorism law, target three vessels and their owners: the Tulip BZ, the Maisan, and the White Whale. All three delivered fuel at Ras Isa after the general license expired. One of the ships, the Tulip BZ, has a history of working with Iran’s Islamic Revolutionary Guard Corps, a group already under heavy U.S. sanctions.

These new sanctions mean that American companies, or any companies using U.S. dollars, must stay far away from these ships and their owners. If not, they could face stiff penalties or lose access to U.S. markets.

Insurance companies are also reacting. One major insurer warned shipowners to be very careful when sending ships to Yemen, especially to ports controlled by the Houthis. The insurer reminded its clients that they could lose coverage entirely if they violate sanctions.

| Port Name | Port Visits |

|---|---|

| Saleef | 330 |

| Aden | 320 |

| Hodeidah | 260 |

| Mukalla | 182 |

| Little Aden | 70 | Total | 1162 |

At Pole Star Global, we track ship operations worldwide in addition to providing information on vessel sanctions and screening. Since July 2024, our PurpleTrac data shows there have been 1,162 port calls for the top five ports by volume in Yemen. This is a subset of the nearly 42k total entries into the Yemeni Exclusive Economic Zone (EEZ) in that same time period. Hudaydah and Saleef, both under Houthi control, rank among the top three most-visited ports in the country. Nearly 100+ ships are currently on their way to those two ports, and over 300+ are heading to Yemen in total.

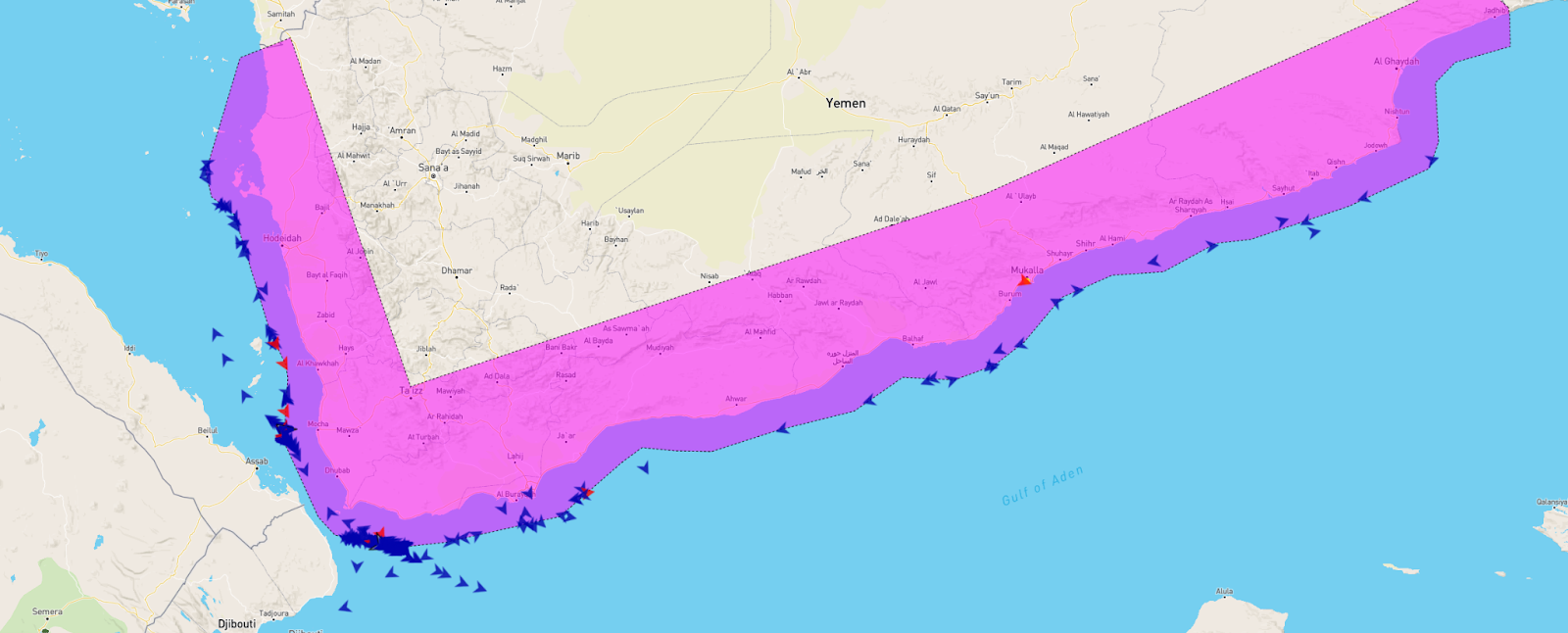

Our PurpleTrac platform has the ability to create different zones of interest. The image below shows a conflict/war zone we have mapped to keep our customers informed of the ongoing risks in the Red Sea & Gulf of Aden. For the conflict zone highlighted in purple we saw ~10k entries in the last 9 month period. Another interesting point here is that before the Israel/Gaza conflict, in the first 9 months of 2023, the Yemeni EEZ saw 100k+ entries compared to 42k in the last 9 months; a drop of more than 60% in this major shipping lane.

Our vessel tracking also shows the types of ships involved. Bulk carriers and container ships make up the majority. But more than 230 oil product tankers and 134 chemical/product tankers have also visited Yemen in the past 9 months.

What this tells us is simple: sanctions are coming in swiftly and compliance is paramount to avoid losses; this is the new normal in maritime compliance. Shipowners, freight brokers, fuel suppliers, and port agents all need real-time insight into vessel movements, port control, and changing sanctions. That’s where Pole Star Global comes in. Our data helps global shipping firms, financial institutions, and others navigate this fast-changing environment, avoiding both physical danger and regulatory hurdles.

With new rules, new designations, and rising tensions in the Red Sea, global shipping companies can no longer afford to look away from what’s happening in Yemen. Staying informed is no longer optional – it’s mission-critical.

*Sourced from the Pole Star Global’s PurpleTrac platform

,