Streamlined Sanctions Compliance

Manage regulatory and reputational risk with Pole Star’s single point sanctions screening and vessel monitoring solution.

Book Your Demo NowALL-IN-ONE SANCTIONS SCREENING

& VESSEL MONITORING SOLUTION

A comprehensive, automated, and API-enabled sanctions compliance solution.

Available as SaaS or API integration.

Screen

Screen vessels against sanctions and enforcement action watchlists.

track

Alerts and monitoring of a vessels historical, real-time and dark activity.

Report

Incorruptible reports for audit trail to demonstrate best efforts in compliance.

LEVERAGE UNMATCHED ACTIONABLE INSIGHTS

Put our comprehensive maritime data sets to work for you so you can be equipped for Maritime Investigations.

0 %

less dark ship false positives than our competitors

0+

Watchlists a vessel is screened against

0+

Jurisdictions a vessel is screened against

0+

Financial Services Clients

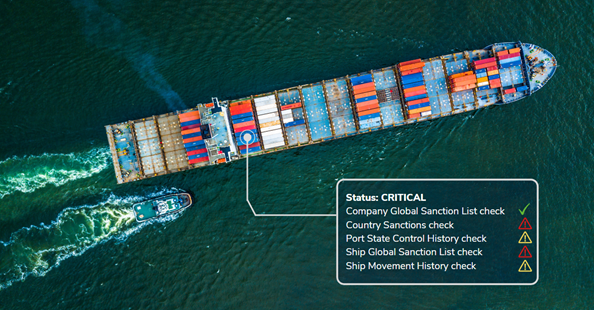

Sanctions Screening

Screen a vessel, its associated ownership, and management against sanctions, proprietary, enforcement action, and other official lists using best-in-class data from our alliance partners, Dow Jones Risk and Compliance.

- Global Sanctions: A list of international sanctions, denied parties, and enforcement action lists.

- Country Sanctions: A ship’s Flag and associated companies’ countries of registration domicile and control.

- Port State Control: The ship’s entire Port State Control history.

- Ship Movement History: A ship’s historic movements, highlighting visits to high risk or sanctioned ports.

Dark Activity/Ship-to-ship Transfer Risk

Investigate periods of AIS non-reporting and spoofing to identify vessels involved in illicit activity.

Enhanced Vessel Intelligence

Monitor vessels suspected of illicit activity, by performing further analysis on non-reporting gaps for full visibility of your marine assets and logistics using our Maritime Domain Awareness linkout.

Illicit Activity Monitoring

- Detection & Alerts: Notifications for high risk activity, e.g. entry to blacklisted port.

- Hybrid Track Technology: A single trail combining AIS and Inmarsat position data.

- Customisable features: Bespoke screening parameters, e.g. country/port blacklists.

RiskCenter Trade Compliance

Dow Jones’ RiskCenter Trade Compliance allows users to conduct routine checks on key aspects of a transaction to ensure compliance with sanctions and dual-use goods regulations. Trade Compliance now includes access to PurpleTRAC for a more complete view of regulatory risks faced by organisations with exposures in maritime trade.

“Using the PurpleTRAC system and with support from Pole Star, our Compliance Officers can assess the movement of goods faster and more easily. They can therefore make quicker decisions, minimizing the bank’s and our customers’ risk of breaching international sanctions.”

Madalina Titiriga

Head of Compliance