This time last year, following over a year of consultations with the maritime industry, the U.S. Department of State, U.S. Department of Treasury, and the U.S. Coast Guard issued the long-awaited sanctions advisory for the maritime industry.

The piece was the first of its kind to specifically target the wider maritime industry and highlight the importance of the private sector with regards to preventing sanctions evasion and illicit shipping activities, which was pivotal for all those with exposure to maritime trade.

Whilst the advisory was non-binding, ship owners, operators, managers, charterers, brokers, flags, ports, shippers, freight forwarders, commodity traders, insurers, and financial institutions were provided with a clear message to significantly improve their compliance programmes to avoid breaching U.S. sanctions. Quickly following suit came other global regulators, such as the UK’s Office of Financial Sanctions Implementation, with guidance that echoed this sentiment.

A year on, let’s have a look at some of what the maritime industry has seen in terms of regulatory enforcement actions:

June 2020: OFAC designates individuals and entities related to Venezuelan oil sector

For years, the U.S. has used sanctions against Venezuela as a policy tool to combat narcotics, human trafficking, human rights violations, and terrorism-related activity, and 2020-2021 was no exception. With the Venezuelan crisis continuing, the U.S. has upheld its existing sanctions while placing more individuals, foreign entities, and vessels on designation lists.

In June 2020, shortly after the release of its advisory to the maritime industry, OFAC identified the attempts of individuals and entities to evade U.S. sanctions on the Venezuelan oil sector. As a result, action was taken against crude oil tanker owner, Delos Voyager Shipping Ltd. The vessel is reported to have delivered 515,000 barrels of Venezuelan crude to Qingdao, China and engaged in an illicit ship-to-ship transfer near Malaysia while transporting another 515,000 barrels from Amuay Bay.

Similarly, a designation has also been applied to Romina Maritime Co. Inc, the registered owner of the crude oil tanker Euroforce, which is said to have transferred 500,000 barrels of Venezuelan crude to another vessel in the South China Sea.

OFAC has made it clear that nobody engaging in illicit practices, or using shortcuts in their compliance processes, is safe. But, with such a large number of transactions happening daily, there is a lot to look at and track for those involved in maritime trade. OFAC’s guidance when monitoring for suspicious vessel behaviour, focuses on identifying deceptive shipping practices, including STS transfers. However, basic vessel screening no longer provides the level of detail needed to mitigate this risk and show best efforts in compliance.

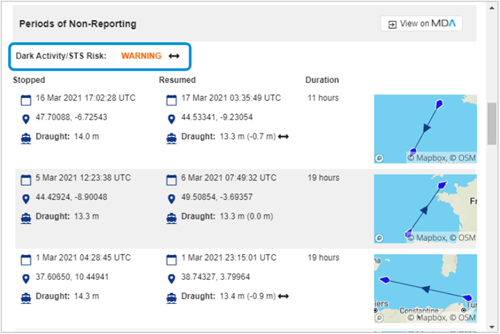

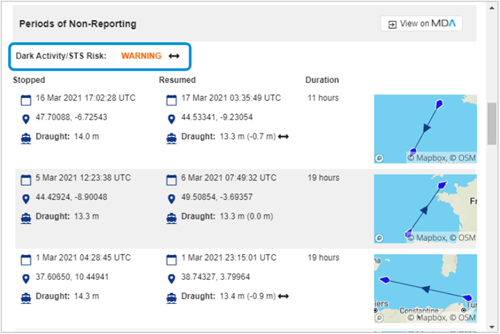

Recognising suspicious transshipments that are used to conceal the origin or destination of transferred cargo is like looking for a needle in a haystack. Vessels engaging in illicit STS transfers tend to turn off their AIS transmissions. While this alone doesn’t indicate anything illicit, OFAC recommends taking into account a series of other factors. For example, did the vessel last transmit its AIS in a high-risk area? Or, has the vessel recently bypassed a sanctioned country?

Now, with Pole Star’s sanctions screening and vessel monitoring solution, PurpleTRAC, it is possible to take STS transfer investigations one step further. In the case of suspicious behaviour, users can also check draught changes during periods of non-reporting. The system will then provide an STS risk indicator for further clarity, based on the details of the situation.

December 2020: OFAC designates companies and vessels related to North Korean trade

While the North Korean sanctions regime has been in place for a while now, recent reports indicate that the maritime industry continues to be exploited for the DPRK’s illicit import and export of goods, including those for its nuclear and ballistic missile programmes. Since the May 2020 advisory, the DPRK’s sanctions evasion techniques have not just continued, but increased, particularly for the acquisition of oil and petroleum products.

In December of last year, OFAC designated 6 companies and 4 vessels for violating existing UN sanctions by engaging in the prohibited North Korean coal trade. Such examples highlight weaknesses within the global supply chain, as individuals, companies, and corporate service providers continue to facilitate, both knowingly and unknowingly, the sanctions evasion activities of the DPRK and, as a consequence, their weapons of mass destruction programmes.

Global regulatory bodies, including OFAC, have made it clear that feigning ignorance is no longer an excuse. However, by demonstrating that you have a sanctions compliance program in place using an audit trail of your best efforts, you will be favourably considered, should you find yourself up against regulators. As such, practicing compliance can ultimately ensure operational continuity in the case of an investigation.

19 January 2021: OFAC designates individuals, entities, and vessels for Venezuelan oil sanctions evasion

On entering 2021, the regulatory focus on the maritime trade industry continued, with OFAC sanctioning and placing on the Specially Designated Nationals (SDN) List 3 individuals, 14 entities, and 6 vessels for their involvement in a network attempting to evade U.S. sanctions on the Venezuelan oil sector.

The regime of President Maduro is noted to have continued its corrupt exploitation of and profit from the state-run oil company, Petroleos de Venezuela, S.A (PDVSA). Since the nationalisation of the Venezuelan oil industry, PDVSA has dominated as the country’s largest, and the world’s fifth largest oil exporter. Since oil reserves in Venezuela are the largest in the world, the state-owned company provides the government with substantial funding.

In 2019, the Trump administration imposed economic sanctions against PDVSA and the Venezuelan central bank, pressuring Maduro to resign. As of January 2021, the U.S. had imposed sanctions on roughly 166 Venezuelan or Venezuelan-connected individuals, yet Maduro remains in power and the designation list keeps growing in an effort to block entities and vessels operating in Venezuela’s oil and shipping sectors.

In order to pinpoint bad actors associated with sanctioned governments like Venezuela, OFAC notes the importance of identifying the ultimate beneficial owner (UBO) of cargo. Bad actors will often take advantage of the complexity of global shipping by using complex business structures, including shell companies or multiple levels of ownership, disguising the UBO to avoid enforcement action. With PurpleTRAC, users can see the registered owner, operator, group beneficial owner, and ship manager details of a vessel.

23 April 2021: DOJ announces charges of sanctions evasions related to North Korea

Last month, the U.S. Department of Justice announced the filing of a criminal complaint charging the individual, Kwek Kee Seng, with conspiring to evade economic sanctions on the DPRK and money laundering. In conjunction with this, one of its tankers was reported to have made illicit deliveries of petroleum products via STS transfers with North Korean vessels, as well as direct shipments to the port of Nampo. The individual is now facing criminal charges as a result of utilising front companies and false documentation to send money through the U.S. financial system. Additionally, his vessel, the Courageous, has been seized to ensure that it no longer enables illicit North Korean trade.

Again, this reiterates the determination of the U.S. to hold every individual, entity, or company that has breached sanctions accountable for placing personal profit ahead of global security.

30 April 2021: Sanctioned tankers serviced in Mexico port

Most recently, 3 Cuban-flagged tankers under U.S. sanctions for transporting Venezuelan oil were serviced in the port of Veracruz, Mexico. The maintenance work on these vessels is a potential breach of sanctions on Venezuela, yet in the past, the U.S. have not brought enforcement actions against shipyards for working on blacklisted vessels.

Under U.S. law, companies and individuals are prohibited from assisting sanctioned entities in this way. It is apparent that authorities in Veracruz are unlikely to have checked if the tankers were sanctioned, so may have inadvertently authorised blacklisted vessels.

The May 2020 OFAC advisory has made it clear that nobody is safe from regulatory scrutiny, particularly not if dealing in USD. Anyone, including shipyards, providing services to a vessel should be checking that the vessel and the shipping companies are not sanctioned prior to engagement to avoid situations like this latest event in the port of Veracruz.

What should you be doing to mitigate the risk of breaching sanctions?

The advisory was one of the most holistic regulatory documents to come out regarding the maritime industry. It raised well known weaknesses that have long been used by those seeking to flout sanctions programs.

At Pole Star we develop solutions to keep you at the forefront of maritime insight. Designed with and for companies with exposures in maritime trade and shipping our regulatory technology, PurpleTRAC, enables the automation, streamlining, and recording of regulatory processes within a user’s sanctions compliance program. Users can configure their own unique risk parameters to generate accurate results in seconds and produce an incorruptible report for audit.

Perform a sufficient vessel investigation with PurpleTRAC by:

Checking ship details: View a ship’s characteristics and particulars, and screen the ownership and management against global, country, and company sanctions lists.

Tracking vessel location continuously: Utilise persistent tracking provided by the aggregation of Inmarsat or Iridium positional data with AIS, creating a multi-source tracking solution that works even when the AIS is unavailable.

Analysing non-reporting AIS gaps: Check AIS reporting gaps for frequency, high-risk locations, draught change, and suspicious vessels in close proximity.

Monitoring high-risk areas: Investigate vessels in high-risk transshipment areas and regulatory zones for a full picture of vessels in relation to areas of interest.

Read our breakdown of the May 2020 OFAC Advisory here.